We’ve put collectively simplified travel insurance coverage information. What to see before you go for travel insurance? Let’s find it here.

We’re not specialists, so it’s all the time vital to speak straight with an insurer, however, this submission gives you a superb start line for what you have to search for in travel insurance coverage. More reading is recommended before you go for one travel insurance.

When it comes to the task of selecting the optimal travel insurance policy, an array of factors demands your attention to ensure that you secure the utmost suitable coverage tailored to your distinctive needs. Let us embark on a journey of exploration, delving into the intricacies and considerations that should occupy the forefront of your decision-making process.

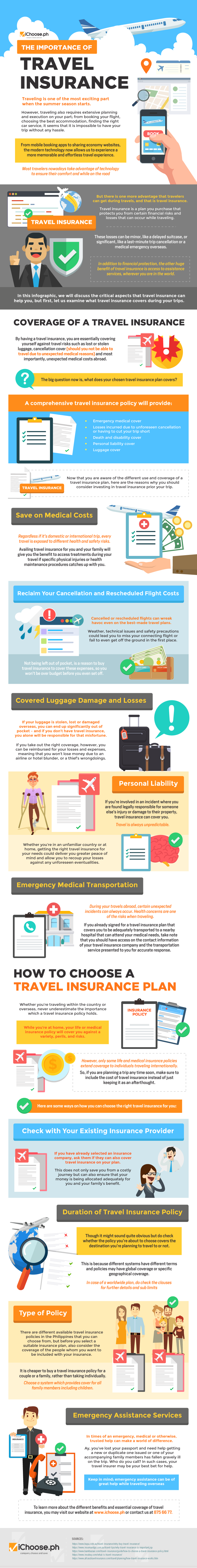

WHY YOU NEED TRAVEL INSURANCE?

We’re typically shocked when some travelers say they don’t travel with insurance coverage. To us, it’s as important to a journey as shopping for an aircraft ticket, backpack, or lodging.

Their excuse for not having it usually revolves around the price, which, contemplating the general value of travel insurance coverage, is silly.

We predict it’s fairly easy; when you can’t afford or can’t be bothered shopping for travel insurance coverage coverage, you shouldn’t be traveling.

Why? As a result of not having it’s dumb.

Have you ever heard the horror tales of somebody having their digital camera stolen while asleep on a bus? What about somebody being bitten by an animal and struggling with an infection?

Or the lady who cycled alongside Bolivia’s dying highway, solely to go flying off the sting and incur extreme again accidents? In case you have, you’ll realize that with our travel insurance coverage, these individuals can be f****d.

Travel insurance coverage supplies you with medical protection when you get sick or injured; will reimburse you in case your digital camera or electronics break, your flight is canceled if a household emergency happens and it’s important to come dwelling, or when you lose a bag, or one thing is stolen.

It’s insurance coverage coverage in opposition to the inevitable points which come up when traveling and may save your life or prevent a lifetime of extreme debt.

Don’t ever depart your dwelling without travel insurance coverage.

WHAT TO LOOK FOR IN A TRAVEL INSURANCE POLICY?

Hopefully, we’re beginning to persuade you of the way importance it’s to purchase insurance coverage in your subsequent journey. If we haven’t, disgrace on us!

So, what do you have to search for in travel insurance coverage? It’s vital to handle the price vs coverage dilemma, however, with so many choices on the market, this may be the toughest half.

We’ll purpose to simplify it as a lot as potential, nevertheless, it’s actually vital you examine the coverage wording to work out whether or not the plan is best for you and your deliberate travels. In case you’re not sure, communicate with the insurer.

1. Medical expenses

In the beginning, we suggest in search of a plan that has excessive protections on medical bills. restrict is $100,000, as this must be sufficient to cover even essentially the most critical medical payments.

In case you go too low, you danger of not being totally lined up for critical medical emergencies.

It’s additionally vital to search for a plan that covers emergency evacuation and care, particularly when you’re visiting a risky location place the chance of evacuation could also be a lot larger than in different international locations (i.e. Nepal following the 2015 earthquake).

2. Medical coverage

We’re fairly certain you don’t need to pay a big medical invoice when you’re taken sick or have an accident while on vacation, so it’s vital that you simply test precisely what your coverage’s medical covers are.

Do they cover mountain biking accidents? Mountaineering within the Himalayas? Quad biking in Greece? Some insurance policies will not cover the above actions, others will solely cover you when you’re traveling with a good supplier. All the time. Learn. High quality. Print.

Consultants usually suggest £ 2 million of medical cover when you’re traveling overseas, which ought to embody repatriation if you have to be flown again to your private home.

Some insurance policies could have bigger limits, nonetheless, you have to ask yourself whether or not it’s crucial, in any other case you possibly can be paying over the percentages for insurance coverage you don’t want.

3. Personal liability

Private legal responsibility is extraordinarily vital because it covers you when you injure somebody, resembling in a bike accident, browsing, or snowboarding, they usually make a declaration in opposition to you. It’s subsequently crucial to have covered as much as £1million.

4. The Spectrum of Coverage Options

Plunge into the vast realm of coverage options, gracefully extended by a diverse array of insurance companies. Immerse yourself in a cornucopia of areas that should encompass not only medical expenses, but also the realms of trip cancellation and interruption, emergency medical evacuation, the retrieval of lost baggage, and the shield of personal liability. Your discerning eye must discern the coverage areas that rise above the rest, resonating harmoniously with your unique and visionary travel plans.

5. The Quandary of Duration

Engage in profound contemplation of the duration that characterizes your upcoming journey and the frequency with which you embark upon such thrilling adventures.

Maintain a keen awareness that certain insurance policies may impose limitations on the temporal tapestry of your voyage, or in some instances, solely extend their protective embrace for a predetermined number of days per annum. Hence, it is incumbent upon you to orchestrate a symphony of alignment, ensuring that the policy dances in perfect unison with the rhythm of your travel ambitions.

6. The Mandate of Destination

Elevate the prioritization of your endeavors, commencing with an ardent quest to determine whether your coveted destination finds itself encapsulated within the confines of the policy in question.

Glean a deep understanding of the labyrinthine nuances that govern the coverage, for certain policies, may adopt exclusions or impose restrictions upon specific countries or regions. Thus, you must ascend to the zenith of certainty, ensuring that the coverage extends its generous reach to the very tapestry of locations that beckon you with tantalizing allure.

7. The Tapestry of Medical Marvels

Navigate the vast and intricate tapestry of medical coverage that a policy unfurls before you. Eagerly scrutinize the depths to which it delves, ensuring that it stands resolute in the face of medical emergencies, the embrace of hospitalization, the sanctuary of doctor visits, the provision of essential prescription drugs, and even the delicate realm of pre-existing medical conditions.

As you embark on this voyage of comprehension, acquaint yourself with any potential exclusions or limitations that may lay in wait, standing as gatekeepers to your understanding of the comprehensive nature of the coverage.

8. The Intricacies of Deductibles and Limits

Embrace the pursuit of meticulous examination, for it is through this ardent endeavor that the true essence of the deductibles and coverage limits attached to various facets of the policy shall reveal itself.

With unwavering resolve, ascertain that these boundaries stand steadfast in the face of potential expenses, extending their protective embrace to shield you from the weight of looming medical bills or the sudden loss of cherished belongings. In this introspective journey, consider the deductible amount that resonates harmoniously with the cadence of your financial comfort.

9. Baggage and belongings

Most, if not all insurance policies ought to pay out as much as £1,000+ in case your baggage or private belongings are misplaced, broken, or stolen.

It’s price noting that dearer gadgets, resembling cameras or laptops will not be lined, and it’s best to test the ‘single merchandise restrict’ earlier than shopping for insurance coverage.

If you would like your costly belongings lined, you’ll must both improve your ‘single merchandise restrict’ to cover the extras or get separate, particular insurance coverage.

This is essential for individuals who travel with plenty of gear and the best insurance!

10. The Balance of the Economic Equation

Engage in a symphony of comparison, harmonizing the costs entwined with different insurance policies while orchestrating a delicate dance with the comprehensive nature of their coverage.

Gaze upon the horizon, for it is here that a cautionary beacon shines forth, illuminating the potential perils of embracing policies swathed in lower costs, knowing full well that they may conceal within their depths limited coverage or higher deductibles. With a discerning eye, strike a judicious balance between affordability and the embrace of comprehensive coverage, securing a symphony of optimal value.

11. The Language of Exclusions

Turn your gaze to the language of exclusions, for it is within these carefully crafted clauses that the true essence of protection is unveiled. Peer into the depths of the policy’s soul, bearing witness to the truths it reveals, exposing the situations and activities that find themselves unwelcome within its hallowed embrace.

Common exclusions may entangle you in the realm of high-risk sports, forbid you from engaging in illicit activities, or even close their protective wings when it comes to pre-existing conditions. Arm yourself with the knowledge born from familiarity, for it is this understanding that shall shield you from the unwelcome surprises lurking in the shadows.

12. Added Advantages

With an eager heart, seek out the symphony of supplementary benefits and enchanting perks that dance upon the stage, offered by the generous hands of insurance providers. Here lies an opportunity to envelop yourself in a cloak of round-the-clock assistance, to immerse yourself in the embrace of bespoke travel concierge services, or to revel in the secure knowledge that unexpected delays or missed connections shall not cast a shadow upon the canvas of your travel experience.

These cherished extras possess the power to elevate and enrich the symphony of your sojourn, breathing life into each moment and unveiling the true essence of a transformative travel experience.

13. The Embrace of Fine Print

Immerse yourself in the poetry of the fine print, allowing the words to cascade upon your senses, revealing the intricate dance of the policy’s terms and conditions. Absorb the details that entwine the claims process, the requirements that linger upon the delicate precipice of documentation, and the specific conditions that guide the very essence of coverage.

With a mindful eye, embrace the cadence of time-sensitive obligations that beckon you, urging you to report incidents or file claims with unwavering diligence. This comprehensive understanding of the tapestry of intricacies shall empower you, guiding your footsteps through the labyrinthine challenges that may arise.

14. Reputation and Customer Reviews

Embark upon a diligent exploration, traversing the landscapes of reputation and customer reviews that adorn the realm of insurance companies. Be attuned to the whispers that echo through the corridors of claim settlements, befriend the tales that illuminate the quality of customer service, and immerse yourself in the symphony of satisfaction that resonates through the voices of those who have walked this path before you.

It is within these tales that you shall unearth the essence of a reliable and responsive insurer, a guardian that shall stand resolute and unyielding should the moment arise to traverse the winding path of a claim.

15. Cancellation

It’s nice to be lined up for the cancellation of your vacation. Ought to the worst occur, you or a member of the family falls sick, or household circumstances change and you have to return to dwelling, you should not have to fret about making an attempt to recoup your cash. restrict is around £3,000, or the full value of your journey.

All the time, keep in mind to learn the high-quality print to see what degree of canopy you’re afforded.

As an example, you will not be lined up when you’re returning dwelling for a significantly sick good friend, as they don’t seem to be a direct member of the household.

16. Delays

Most insurance coverage insurance policies ought to cover you for flight delays over 12 hours. Examine the coverage wording to ensure.

17. Emergency assistance

Many insurers have 24-hour emergency helplines, that are extremely useful ought to one thing occur.

General, an important travel insurance coverage, and one it’s best to purpose to get ought to cover the next:

The locations you’re visiting

cover private legal responsibility protection you when you injure somebody

Some protection in your electronics (and have the choice of better protection restriction)

Cover damage and sudden sicknesses

Twenty-four-hour emergency providers and assist

Cover misplaced, broken, or stolen possessions like baggage, paperwork, cameras, and many others.

Cover cancellations resembling flights, resort bookings, and different transportation bookings you probably have a sudden sickness, dying within the household, or another emergency

Emergencies, strife within the nation visited, and many others., that trigger you to go dwelling early

Monetary safety if any firm you’re utilizing goes bankrupt and you’re caught in a foreign country.

We’re no specialists, however, one factor we’ve learned over our time traveling is that it positively not prices going for a budget choice in terms of travel insurance coverage.

When researching, test the high-quality print with a tooth comb and ensure the insurance coverage coverage you in the end select is related to you and covers you for precisely what you want.

Final thought

In the tapestry of your pursuit, it is essential that you imbue each moment with a meticulous assessment of your unique travel needs, that you traverse the hallowed halls of policy documents with unwavering resolve, and that you carefully weigh the specific details of each insurance policy upon the scales of discernment.

Should doubts and questions linger within the caverns of your mind, do not hesitate to seek the guiding light of clarification and guidance directly from the very insurance providers that weave the fabric of protection.

Other Recommended Reading

- Hairstyle for Men with Curly Hair – A Complete Guide

- Daily Good Habits to Have for A Better Life

- Good Habit of Eating for an Evergreen Life

- Madagascar National Park – Wonderful Ecosystem

- Plitvice Lakes National Park in Croatia

- Bora Bora Island – Where is Bora Bora Island on Map?

- Phi Phi Islands in Thailand | Hotels | Tours | Resorts

- Santorini Island in Greece – Santorini Greek Islands Travel

- Makena Beach Maui – Snorkeling | Resort | Golf Club

- Maui Island in Hawaii for Unforgettable Tourist Experience

- Diamond Head Hike Oahu Travel Guide

- Honolulu Travel Guide for the Adventurous Tourists

- Things to Know Before Hiking Diamond Head

- Hanauma Bay of Hawaii with Snorkeling Hours

- Iolani Palace Hawaii Honolulu History Tour

- Manoa Falls Trail Hike Adventure for the Brave

- Koko Crater Railway Trail Head Tracking Guide

- Benefits of Travel Credit Cards